5 Core Compliance Pains for Correspondent Banks and Chaindots’ remedies for them

Correspondent banking, by its nature, involves significant compliance risks. For a BSA Officer managing these risks is not just about meeting regulatory requirements—it’s about protecting the institution from financial crime and reputational damage.

What are the primary pain points, and how can they be remedied?

Pain 1: Inadequate Due Diligence

The challenge: By the nature of their business, correspondent banking often lacks direct visibility into the end-users, Thorough due diligence on respondent banks and their customers can be challenging due to the following reasons:

Lack of “Know Your Customer’s Customer” (KYCC): This lack of visibility makes verifying customer information difficult, especially across international borders.

Adding to this there are Jurisdictional variations in AML/CTF standards and the inherent complexity of identifying ultimate beneficial owners (UBOs) within multi-layered corporate structures.

Failure in Enhanced Due Diligence (EDD): For high-risk relationships, such as those involving shell corporations, sanctioned nations, or unusual transaction patterns, EDD is crucial. This involves deep background checks, understanding ultimate beneficial ownership (UBO) information for multiple businesses, and screening against global sanctions lists and Politically Exposed Persons (PEPs) databases. The objective for Know Your Business (KYB) onboarding is to create a true and accurate picture of risk, not merely to achieve speed.

Fragmented Compliance Systems and Manual Processes: Many correspondent banks continue to rely on outdated, disconnected systems and manual workflows for critical compliance functions during onboarding. This fragmentation is a major impediment to efficient and effective compliance.

Recommendations:

· Have a Centralized System:

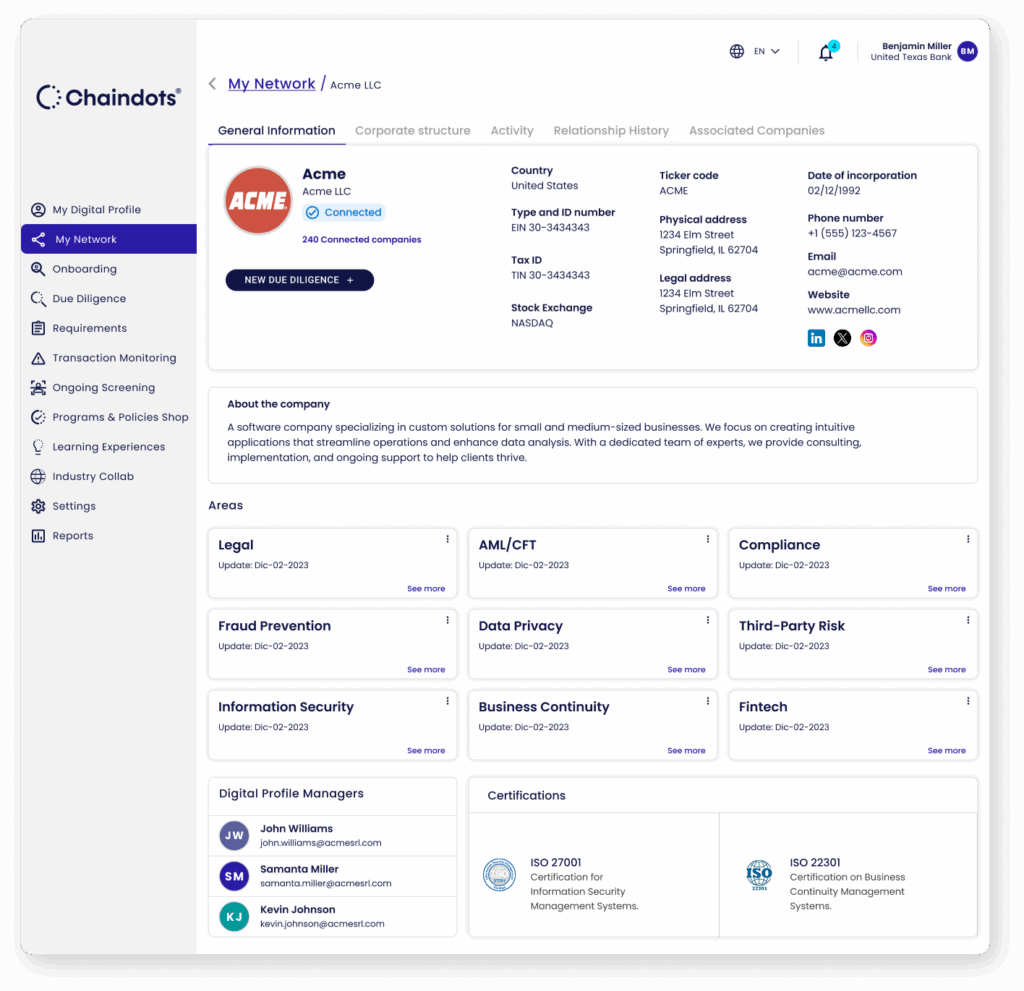

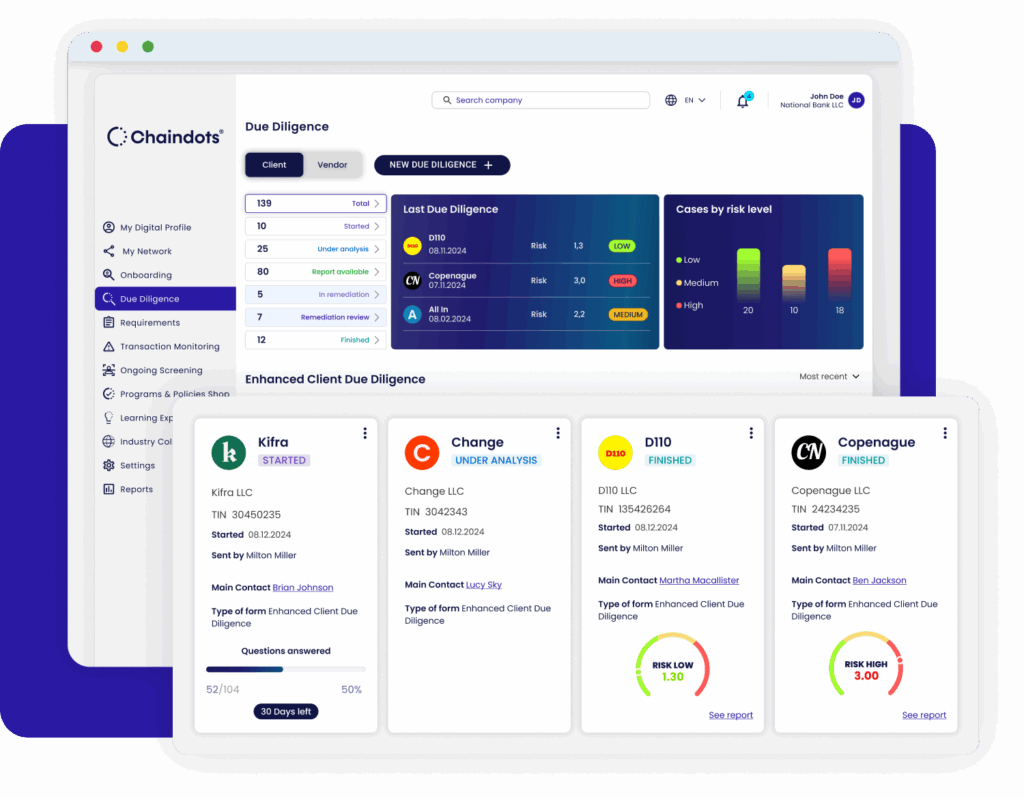

At a recent meeting, the Sr Risk Compliance Officer at a correspondent bank from the US Midwest highlighted a key challenge: “We have different models to assess each type of client risk, however, the models don’t talk to each other. We need something holistic to see the complete picture of our client’s risk profile.” This indicates a clear need for a unified approach. Risk and Compliance tech platforms can help streamline due diligence processes by centralizing Client Risk Assessment and automating tasks, making managing all of your client risk in one place.

Make sure due diligence questionnaires oblige detailed information about their top high-risk corporate clients, including their ultimate beneficial owners (UBOs), their business activities, and their transaction volumes.

A centralized compliance platform streamlines due diligence tasks and consolidates client risk analysis.

· Inter-connected and real-time data Network:

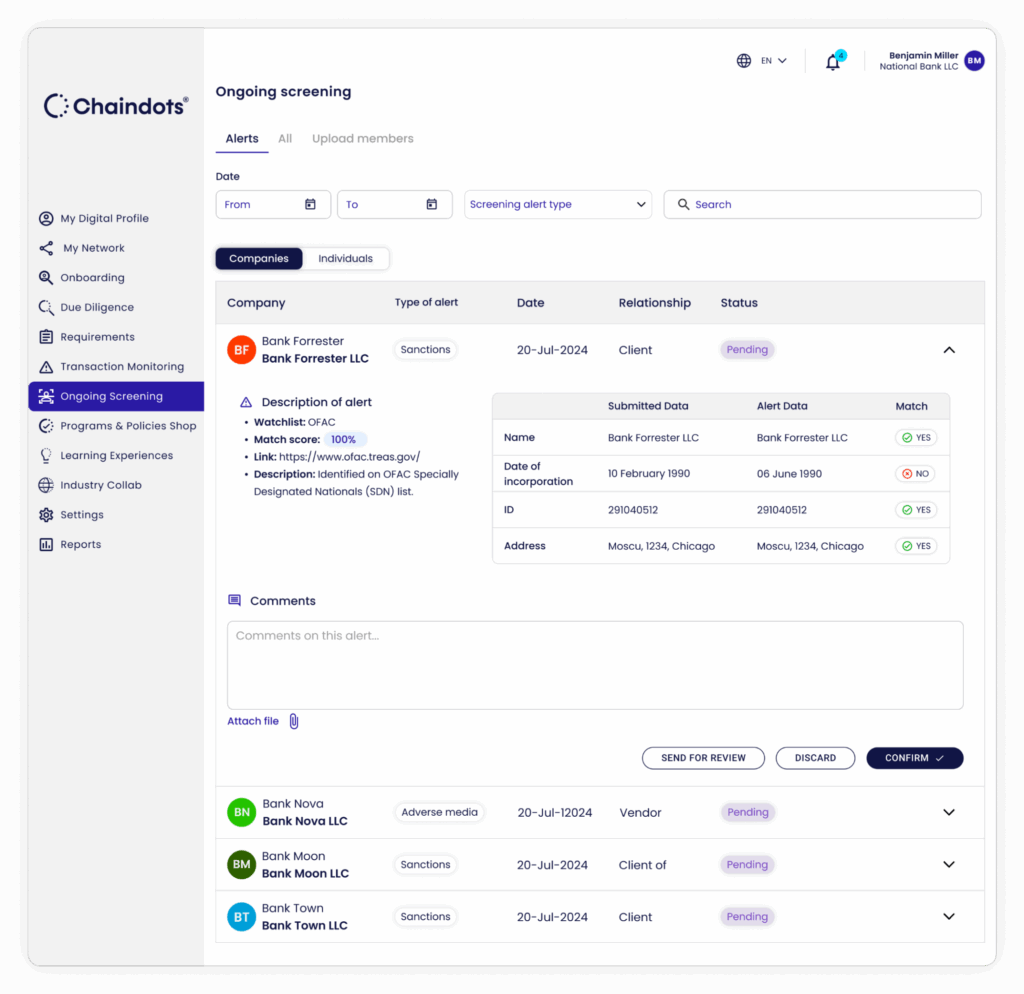

Manually checking client information against sanctions lists and adverse media databases is an arduous task for BSA analysts. However, top-tier tools now automate this process by cross-referencing these sources, eliminating the need for manual review.

Real-time screening enables continuous monitoring of correspondent bank clients, even after onboarding. This process generates comprehensive ongoing risk reports.

· Client Workflow Automation:

Manually initiating and remediating documentation requests via email from the BSA officer or bank relationship manager can lead to manual errors, unnecessary delays, and incomplete information.

Deploy systems that streamline workflows with automated follow-ups, approval and rejection tools, task assignments, and a centralized dashboard to manage all client data in one place. Automation minimizes manual errors, improving accuracy, and ensuring compliance.

Automated systems with built-in follow-up, approval, and rejection features can significantly reduce manual errors. This not only expedites communication but also enhances the accuracy of documentation requested.

Pain 2: The AML/CFT constant struggle.

The Challenge: The high volume of cross-border transactions makes correspondent banking a prime target for money laundering and terrorist financing. Detecting suspicious activity is a constant struggle, often leading to significant regulatory penalties.

Insufficient Ongoing Monitoring and IT System Failures

A common error treating onboarding as the end of due diligence, leading to critical vulnerabilities.

Financial crime threats are dynamic, requiring continuous updates to risk assessments rather than mere checklist adherence. It is an ongoing process that must be managed throughout the entire lifecycle of a correspondent relationship.

Lack of continuous monitoring systems can lead to undetected changes in risk profiles and missed suspicious activities. Correspondent banks with inadequate IT systems, can face challenges to monitor against sanctions list updates, changes in Ultimate Beneficial Owner (UBO) status, or negative news.

Recommendations:

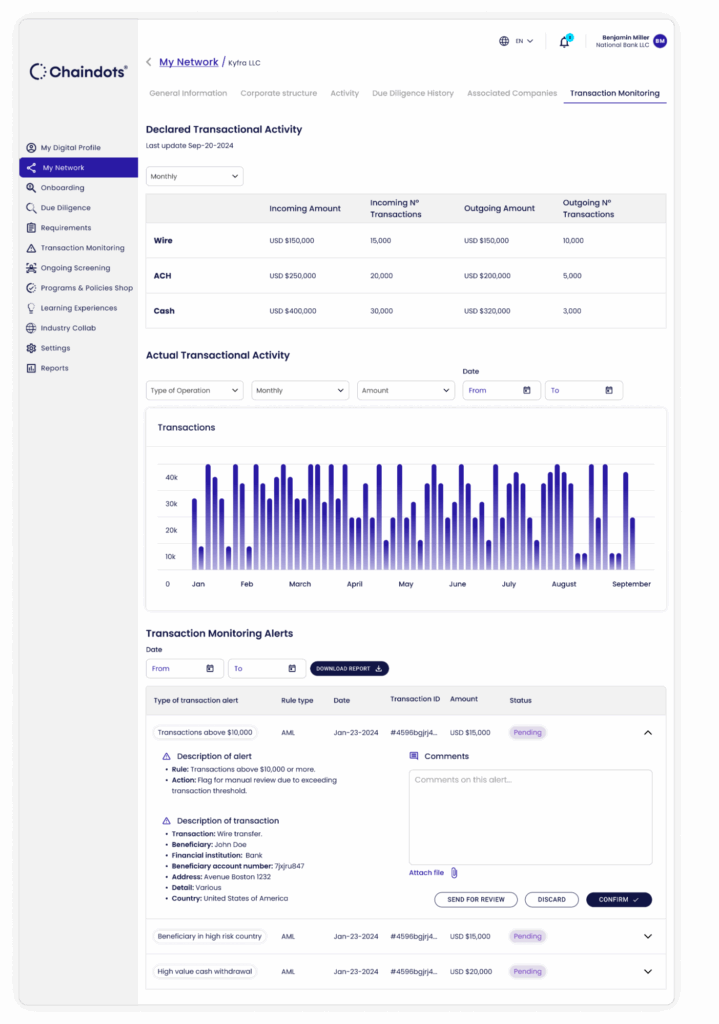

A continuous Transaction Monitoring system can help detect and flag suspicious activity in real-time by setting up suspicious activity rules combined with machine learning models that use unsupervised learning to analyze a vast amount of historical data to establish a baseline of “normal” behavior for a respondent bank and its customers.

These rules can consist of:

- Behavioral Rules: flags pattern of large, sudden incoming funds followed by rapid outgoing transfers.

- Geographic Rules: flags transactions originated from a country known for money laundering risks.

- Structuring Rules: detects when a customer breaks down the large, incoming sum into multiple smaller transactions to avoid triggering mandatory reporting requirements.

- Identify previously unknown or emerging patterns of illicit activity.

Transaction Monitoring models can detect subtle correlations between seemingly unrelated transactions, such as “structuring” (breaking large sums into smaller ones) or the use of multiple nested accounts to obscure the true beneficiary.Use Behavioral Profiling and Dynamic Risk Scoring

Instead of static risk categories, AI powered models can create dynamic, real-time behavioral profiles. These models can continuously learn and update a risk score based on an account’s transactional history, geographic locations, transaction counterparties, and other factors. A sudden change in behavior—such as a shift in transaction volume, value, or destination—will automatically trigger a high-priority alert for human review. This allows for a more granular and accurate risk assessment than traditional methods.

A Transaction Monitoring solution analyzes inbound and outbound transactions — including ACH, wire transfers, card payments, checks, cash, and P2P — continuously against 500+ AML rules to surface high-priority alerts and suspicious patterns, ML models are effective in detecting potential financial crimes, suspicious behaviors, and regulatory breaches. This enables businesses to identify and address unadvertised issues.

Pain 3: “Nested Banking” – The Hidden Network Risk

The Challenge: One of the most significant risks in correspondent banking is “nested correspondent banking,” where a respondent bank extends its correspondent relationship to sub-respondent banks. This arrangement enables indirect access to the correspondent’s services without direct oversight or due diligence, increasing the risk of financial crime and undermining the integrity of the financial system. Such hidden layers create a substantial blind spot for compliance teams.

Recommendations:

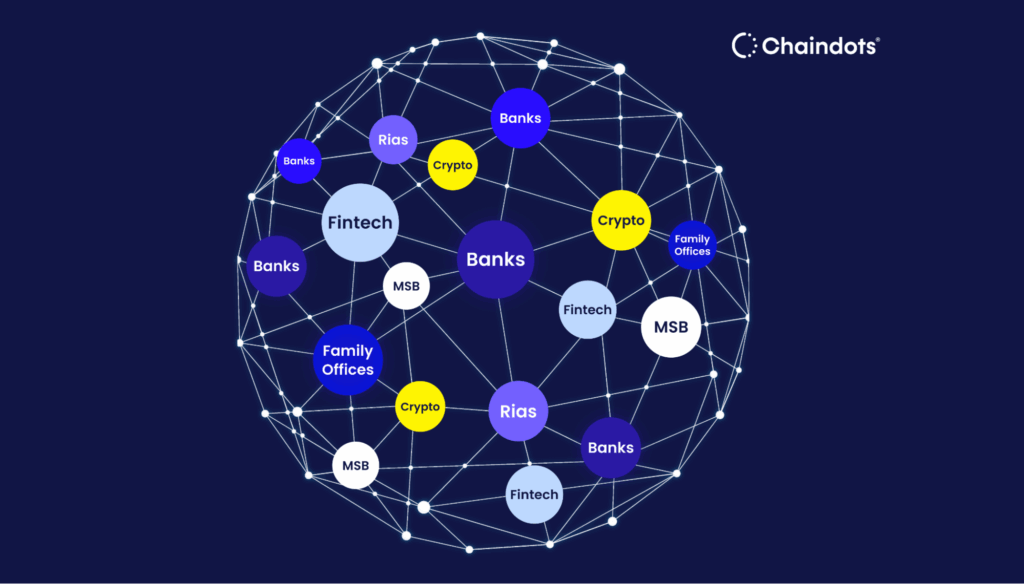

Look for collaborative platforms with networking mapping features that provide visibility and allow you to track and analyze “clients of clients” risks. By mapping parent-child relationships, you can screen these sub-respondent banks against sanctions lists, Politically Exposed Persons (PEPs) lists, and adverse media databases. If any sub-respondent is flagged as high-risk, the correspondent bank can either refuse the relationship or impose stricter controls.

Networking mapping provides visibility and a great understanding of correspondent banking relationships and client of client risks.

Pain 4: Operational Inefficiency and High Costs

The Challenge: Increasing compliance standards and regulator pressure drive up costs and demand more resources. Manually updating risk assessments for thousands of clients and lengthy review times drain resources and impede business operations.

Recommendation: Automated all-in-one risk management platforms streamline workflows to reduce manual effort and accelerate operations. Replace manual exchange of Emails, Docs, and Spreadsheets with a Centralized Database of your business ecosystem. All security screenings should ideally be done in the same platform and if additional validation is needed you can trigger system-generated automatic requests and approvals.

Streamlined KYC approvals and remediation are achievable through centralized documentation and report management.

Pain 5: The De-Risking Dilemma – Balancing Risk and Access

The Challenge: Driven by concerns over regulatory and reputational risk, many correspondent banks engage in “de-risking”—terminating relationships with entire regions or customer groups. While seemingly a risk mitigation strategy, de-risking is not aligned with FATF recommendations and can paradoxically lead to financial exclusion, reduced transparency, and increased exposure to illicit activities by driving transactions underground.

Recommendation:

Strive for End-to-End Visibility: where Correspondent banks can demonstrate if the respondent bank’s transactions have been consistently low-risk, with no suspicious patterns. Thereby proving the suspicious activity is a one-time event.

Using a Remediation strategy, the compliance officer creates a task for the respondent bank to provide a written report on the breach, including steps they have taken to prevent a recurrence. This avoids de-risking a healthy client and limits exposure from the FATF.

In an increasingly complex global financial landscape, technology is no longer a luxury but a necessity for correspondent banking. Chaindots offers a holistic, AI-powered, and collaborative platform that directly addresses the most pressing compliance pains, enabling banks to not only meet regulatory demands but also to grow safely and sustainably.